What Michigan Families Should Know About Surety Bonds

Bail isn’t just a number. It’s a wall that stops families cold. In Michigan, surety bonds are the only way some people get a loved one home before trial. The process is fast, the choices are tough, and the risks are real. Skip the confusion. Here’s what matters when you’re deciding on a surety bond.

Surety Bonds in Plain English

Courts want a guarantee. Defendants want out. Families want options. A surety bond brings all three together. The court gets a promise. The defendant gets a shot at freedom. The family gets a path that doesn’t drain every account.

- Three parties sign on: the court, the defendant, and the surety bail bonds company.

- The bond company steps up and promises the court the full bail amount.

- Families pay a percentage, usually 10%, up front. That’s the fee. It’s not refundable.

- The agreement stays in place until the case ends. No shortcuts. No early exits.

- Bond companies check risk. They look at the charges, the defendant’s record, and the cosigner’s finances before saying yes.

Think of a surety bond as a contract with teeth. The court holds the bond company responsible. The bond company holds the cosigner responsible. The cosigner holds the defendant responsible. Everyone’s on the hook until the last court date wraps up.

Cosigners Carry the Weight

Cosigning isn’t a favor. It’s a commitment. Michigan law sets the bar high. Only legal adults with steady income and strong community ties get approved. The bond company checks job history, credit, and the relationship to the defendant. No shortcuts. No exceptions.

Cosigners take on real risk. If the defendant skips court, the cosigner pays. That’s not a threat. It’s the contract. The court wants its money. The bond company wants its money. The cosigner is the backup plan. Before signing, review every line. Bail conditions and rules spell out what’s expected. Miss a detail, and you pay for it.

- Legal adults only, no minors, no exceptions.

- Proof of income and job stability required.

- Credit checks are standard. Bad credit means higher risk, or no deal.

- Relationship to the defendant matters. Strangers rarely get approved.

Cosigners don’t just sign paperwork. They take on the full financial risk if things go sideways. That’s the reality. No one else steps in to cover the loss.

Financial Stakes Are Real

Money moves fast in the bail world. Cosigners pay the fee up front. That money doesn’t come back, even if the case ends quickly. If the defendant misses court, the cosigner owes the full bail amount. The bond company collects, one way or another.

- Assets can be used as collateral. Houses, cars, savings, nothing is off the table.

- Monthly payments must stay current. Miss a payment, and penalties stack up.

- Payment plans come with extra fees. Read the fine print before agreeing.

- Early termination triggers penalties. The bond company protects its risk.

Smart cosigners keep records. Every payment, every call, every document, save it. Bail hearings set the tone. Know what’s expected before money changes hands. Surprises cost more than most families can afford.

Court Dates Are Non-Negotiable

One missed court date, and the whole deal falls apart. The court revokes the bond. The bond company demands payment. The cosigner faces the bill. No excuses. No second chances.

- Defendants must show up, every time, on time.

- Rescheduling is rare. Judges expect compliance, not stories.

- Missed appearances void the bond. The cosigner pays the price.

Defendants have rights, but obligations come first. Every court date is a deadline. Treat it like one. Families who stay organized avoid the worst headaches. Calendars, reminders, and backup plans keep everyone on track.

What Happens When Things Go Wrong

Sometimes, even careful families hit trouble. The defendant skips town. The court issues a warrant. The bond company starts calling. Cosigners get letters, then bills, then legal action. Collateral gets seized. Credit takes a hit. Relationships strain under the pressure.

- Bond companies use recovery agents to track down defendants.

- Cosigners face lawsuits if the money isn’t paid.

- Assets listed as collateral get repossessed.

- Credit scores drop. Future loans get harder to secure.

There’s no easy fix once the process starts. The contract is clear. The court wants its money. The bond company enforces the agreement. Cosigners who ignore calls or letters only make things worse. Communication matters. So does honesty about what’s possible.

Smart Steps for Michigan Families

Families who handle surety bonds well do a few things right from the start:

- Ask direct questions about fees, collateral, and payment plans.

- Read every document before signing. Don’t rush.

- Keep detailed records, payments, court dates, and all communication.

- Set reminders for every court appearance.

- Stay in touch with the bond company. Problems don’t solve themselves.

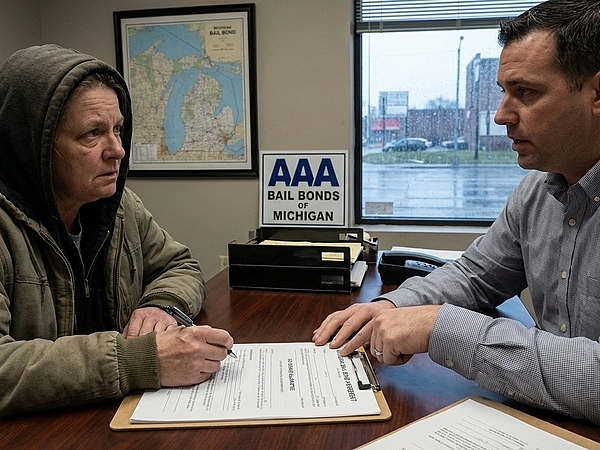

Surety bonds offer a lifeline, but only for families who treat them seriously. The risks are real. The rewards, freedom, stability, a chance to regroup, are worth it for those who stay organized and informed. When families reach out to our team, we help clarify the process and answer the tough questions that come up along the way. At AAA Bail Bonds of Michigan, we know how stressful this can be, and we work to make sure our clients understand every step before they sign.

Get Expert Help Today

AAA Bail Bonds of Michigan provides clear guidance through every step of the bonding process. Call us at 586-757-5001 or contact us to discuss your situation with our experienced team.

‹ Back